```html

Ever feel like you're flying by the seat of your pants when you're trading? One minute you're feeling confident, the next you're second-guessing every decision. What if there was a way to bring some order and clarity to the chaos?

The market's volatility can feel like a personal attack, leading to impulsive decisions, missed opportunities, and ultimately, frustration. You might find yourself chasing trends, forgetting key risk management rules, or simply feeling overwhelmed by the sheer amount of information. The constant pressure to perform can be exhausting, and the lack of a clear plan can leave you feeling lost and disoriented.

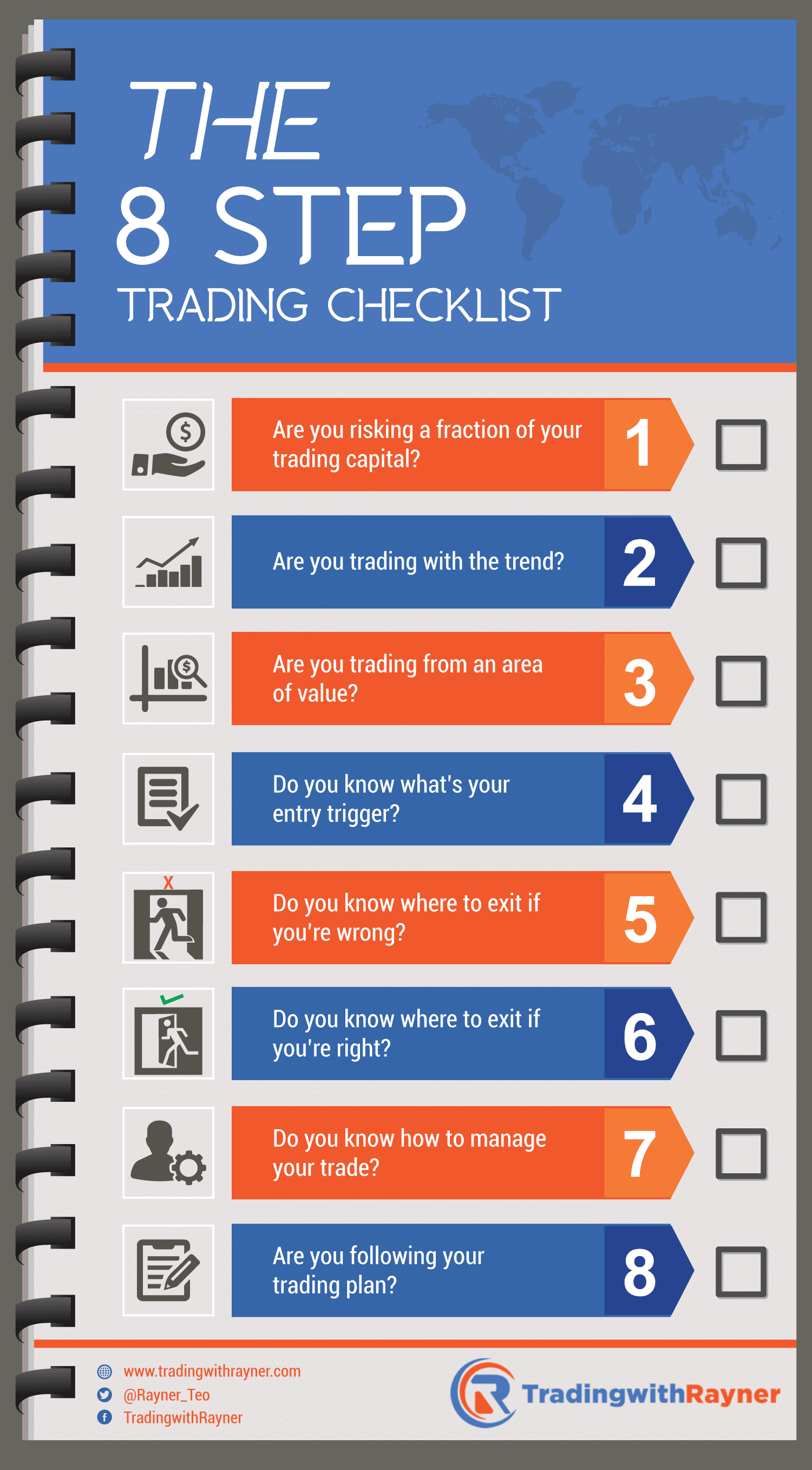

This is where a simple trading checklist comes in. It's your personal guide, designed to help you stay focused, disciplined, and consistent in your trading. By outlining specific criteria and steps before you enter a trade, you can minimize emotional decisions and increase your chances of success.

In this article, we'll explore the benefits of using a trading checklist, how to create one that suits your individual trading style, and how to integrate it into your daily routine. We'll cover key elements to include, such as market analysis, risk assessment, and entry/exit strategies. Keywords: Trading Checklist, trading strategy, risk management, trading plan, consistent trading.

Defining Your Trading Goals

The target of defining your trading goals is to create a clear roadmap for your trading journey. It helps you understand what you want to achieve and provides a framework for evaluating your progress. Without defined goals, it's easy to get sidetracked or make impulsive decisions that don't align with your overall strategy.

I remember when I first started trading, I was all over the place. I jumped from strategy to strategy, chasing quick profits without any real plan. I'd see someone on a forum talking about a particular indicator and immediately try to incorporate it into my trading. Needless to say, it didn't go well. I was losing money and feeling incredibly frustrated. Then, I decided to sit down and write out my goals. What did I actually want to achieve with trading? What was my risk tolerance? What was my time commitment? Answering these questions helped me create a focused trading plan and a checklist to ensure I stuck to it.

Defining your trading goals involves setting both financial and non-financial objectives. Financial goals might include targets for profit, return on investment, or drawdown. Non-financial goals might include things like learning a new trading strategy, improving your risk management skills, or developing a consistent trading routine. Once you have defined your goals, you can create a checklist that helps you stay on track and measure your progress. Keywords: Trading goals, financial objectives, trading plan, risk tolerance, consistent trading.

Identifying Your Trading Style

The target of identifying your trading style is to understand your personality, risk tolerance, and time commitment, and then align your trading strategies accordingly. This self-awareness is crucial for developing a trading checklist that is tailored to your individual strengths and weaknesses.

Identifying your trading style involves understanding your risk appetite, your time horizon, and your preferred market conditions. Are you a day trader, a swing trader, or a long-term investor? Do you prefer trading volatile assets or more stable ones? Are you comfortable with high levels of risk, or do you prefer a more conservative approach?

Understanding your trading style can help you choose the right strategies, the right tools, and the right markets to trade. For example, if you are a day trader, you might focus on short-term price movements and use technical analysis tools to identify entry and exit points. If you are a long-term investor, you might focus on fundamental analysis and hold your positions for months or even years. A checklist will then help you ensure the trades you take are actually aligned with your identified style. Keywords: Trading style, risk appetite, time horizon, trading strategies, day trading, swing trading.

The History and Myth of Trading Checklists

The target here is to explore the historical context of checklists in high-stakes professions and debunk any myths surrounding their usefulness in trading. Checklists have proven effective in reducing errors and improving performance in various fields, and understanding this history can help traders appreciate their value.

The concept of using checklists to improve performance isn't new. In fact, it has a rich history, particularly in aviation. In the early days of flight, pilots relied on their memory and intuition, which often led to errors and accidents. It wasn't until the development of standardized checklists that aviation safety significantly improved. Today, pilots use checklists for everything from pre-flight inspections to emergency procedures, ensuring that critical steps are never overlooked.

Despite the clear benefits of checklists, some traders remain skeptical. One common myth is that checklists are too rigid and stifle creativity. However, the purpose of a checklist is not to eliminate flexibility but rather to provide a framework for making informed decisions. Another myth is that checklists are only for beginners. In reality, even experienced traders can benefit from using a checklist to avoid complacency and maintain discipline. Keywords: Trading checklist history, aviation checklists, trading myths, disciplined trading, standardized trading.

Unlocking the Hidden Secrets of a Trading Checklist

The target here is to reveal the less obvious benefits of using a trading checklist, such as improved emotional control, reduced stress, and increased self-confidence. By understanding these hidden secrets, traders can fully leverage the power of a checklist to enhance their overall trading experience.

Beyond the obvious benefits of improved accuracy and consistency, a trading checklist can also have a profound impact on your emotional state. When you have a clear plan and a defined set of criteria, you're less likely to make impulsive decisions based on fear or greed. This can significantly reduce stress and anxiety associated with trading.

Furthermore, a trading checklist can boost your self-confidence. As you consistently follow your checklist and see positive results, you'll develop a greater sense of control over your trading. This can lead to a more positive and optimistic mindset, which can further enhance your performance. The hidden secret is that a checklist is more than just a list of tasks; it's a tool for building discipline, confidence, and emotional resilience. Keywords: Trading checklist secrets, emotional control, stress reduction, self-confidence, disciplined trading.

Recommendations for Creating an Effective Trading Checklist

The target here is to provide actionable recommendations for creating a trading checklist that is tailored to individual needs and preferences. These recommendations should cover key elements to include, as well as tips for making the checklist easy to use and maintain.

When creating your trading checklist, start by identifying the key elements that are essential to your trading strategy. This might include things like market analysis, risk assessment, entry and exit criteria, and position sizing. Be specific and detailed in your descriptions, leaving no room for ambiguity.

Make sure your checklist is easy to use and maintain. Keep it concise and focused, avoiding unnecessary complexity. Use clear and simple language, and organize the steps in a logical order. Consider using a digital checklist app or spreadsheet to make it easier to track your progress. Regularly review and update your checklist as your trading strategy evolves. And remember, consistency is key. The more you use your checklist, the more effective it will become. This is where discipline comes in handy. Remember to visit XM Broker: https://affs.click/CANq3.

Keywords: Trading checklist creation, key elements, actionable tips, checklist maintenance, consistent trading.

Key Elements to Include in Your Checklist

Diving deeper, this section elaborates on specific components that should be present in most trading checklists, regardless of the specific strategy. These elements often encompass market analysis, risk assessment, and trade management protocols.

A robust trading checklist should cover several key areas to ensure comprehensive decision-making. First, consider including a section for market analysis. This might involve evaluating the overall market trend, identifying support and resistance levels, and analyzing relevant economic indicators. Next, incorporate a risk assessment section. Here, you'll determine your risk tolerance, calculate your potential losses, and set stop-loss orders to protect your capital.

Trade management is another crucial element. This involves defining your entry and exit criteria, determining your position size, and monitoring your trade performance. Finally, include a section for documenting your trades. This will help you track your progress, identify patterns, and learn from your mistakes. Remember to tailor these elements to your specific trading strategy and risk profile. A well-structured checklist will act as your trading compass, guiding you through the market's complexities with clarity and precision. Keywords: Checklist elements, market analysis, risk assessment, trade management, entry/exit criteria.

Practical Tips for Using Your Trading Checklist

The target here is to provide practical advice on how to integrate a trading checklist into your daily trading routine. This includes tips on when and how to use the checklist, as well as strategies for staying disciplined and avoiding common mistakes.

To make your trading checklist truly effective, you need to integrate it seamlessly into your daily routine. The best time to use your checklist is before you enter any trade. Take a few minutes to review each item and ensure that you're meeting all the necessary criteria. Don't skip steps or take shortcuts.

One common mistake is to only use your checklist when you're feeling uncertain or nervous. In reality, you should use it for every trade, regardless of how confident you are. This will help you avoid complacency and maintain consistency. Another tip is to regularly review and update your checklist as your trading strategy evolves. What worked well six months ago may not be as effective today. Finally, don't be afraid to adjust your checklist based on your own experiences and insights. Keywords: Trading checklist tips, daily routine, disciplined trading, consistent application, checklist review.

Common Pitfalls to Avoid When Using a Checklist

This section serves as a cautionary tale, highlighting common errors traders make when implementing checklists and offering guidance on how to steer clear of these mistakes.

While a trading checklist is a powerful tool, it's not foolproof. Many traders fall into common traps that undermine its effectiveness. One frequent mistake is treating the checklist as a mere formality, rushing through the steps without genuine consideration. Remember, the checklist is there to guide your decision-making, not just to be ticked off. Another pitfall is failing to update the checklist regularly. Markets change, and your strategy needs to adapt.

An outdated checklist can lead to missed opportunities or even losses. Moreover, resist the urge to bend the rules to fit a particular trade. The checklist is designed to protect you from impulsive decisions. If a trade doesn't meet all the criteria, it's often best to walk away. By being mindful of these potential pitfalls, you can ensure that your checklist remains a valuable asset in your trading arsenal. Keywords: Checklist pitfalls, trading errors, disciplined adherence, strategy adaptation, risk management.

Fun Facts About Trading and Checklists

The target here is to inject some fun and interesting facts related to trading and checklists, making the content more engaging and memorable.

Did you know that the first documented use of a checklist was in 1935 by Boeing, for the Model 299 aircraft (later known as the B-17 Flying Fortress)? The plane was so complex that pilots found it difficult to remember all the steps required for takeoff. The checklist drastically improved safety and efficiency. It’s interesting to see how a simple concept from aviation has parallels in the high-stakes world of trading!

Here's another fun fact: Some studies have shown that traders who consistently use a checklist tend to have higher win rates and lower drawdowns compared to those who don't. While correlation doesn't equal causation, it suggests that structured decision-making can have a positive impact on trading performance. And finally, even legendary investors like Warren Buffett have a checklist of criteria they look for before investing in a company. Keywords: Trading facts, checklist history, Boeing checklist, Warren Buffett, structured decision-making.

How to Personalize Your Trading Checklist

The target here is to provide a step-by-step guide on how to customize a generic trading checklist to fit individual trading styles, risk tolerance, and market preferences.

Creating a personalized trading checklist is essential for maximizing its effectiveness. Start by identifying your core trading strategy. What markets do you trade? What timeframes do you use? What indicators do you rely on? Once you have a clear understanding of your strategy, you can begin to tailor your checklist to reflect your specific needs.

For example, if you're a day trader, your checklist might include steps for analyzing pre-market data, identifying potential breakout stocks, and setting tight stop-loss orders. If you're a swing trader, your checklist might focus on analyzing longer-term trends, identifying key support and resistance levels, and managing your positions over several days. The key is to make your checklist a reflection of your unique trading style and risk profile. The more personalized it is, the more effective it will be. Keywords: Trading checklist personalization, trading strategy, risk profile, day trading checklist, swing trading checklist.

What If Your Checklist Fails?

The target here is to address the possibility of a trading checklist not working as expected and to provide solutions for troubleshooting and improving its effectiveness.

Even the most well-designed trading checklist can sometimes fail to deliver the desired results. If you find that your checklist isn't working, don't despair. The first step is to identify the root cause of the problem. Are you consistently skipping steps? Is your checklist outdated or incomplete? Are you trading in markets that don't align with your strategy?

Once you've identified the problem, you can begin to take corrective action. If you're skipping steps, try setting reminders or creating a more user-friendly checklist. If your checklist is outdated, take the time to review and update it based on your recent trading experiences. If you're trading in unsuitable markets, consider diversifying your portfolio or focusing on markets that are more aligned with your strategy. Remember, a trading checklist is a tool that should be constantly refined and improved. Keywords: Trading checklist failure, troubleshooting, problem-solving, checklist refinement, market diversification.

A Listicle of Trading Checklist Benefits

The target here is to present a concise list of the key benefits of using a trading checklist, making the content easy to scan and digest.

Let's break down the power of a trading checklist into a simple list: 1. Improved Discipline: A checklist enforces adherence to your trading plan.

2. Reduced Emotional Trading: By following pre-defined steps, you minimize impulsive decisions.

3. Increased Consistency: A checklist ensures that you apply the same criteria to every trade.

- Enhanced Risk Management: By incorporating risk assessment into your checklist, you protect your capital.

5. Better Decision-Making: A checklist provides a framework for analyzing market conditions and identifying opportunities.

6. Increased Confidence: By consistently following your checklist, you build trust in your trading process.

7. Improved Tracking: A checklist helps you monitor your progress and identify areas for improvement. These are just some of the many benefits of using a trading checklist. Keywords: Trading checklist benefits, improved discipline, emotional control, risk management, consistent trading.

Question and Answer Section

Q: How often should I update my trading checklist?

A: You should review and update your checklist regularly, at least once a month, or whenever you make significant changes to your trading strategy.

Q: Can I use the same checklist for all markets?

A: It's best to create separate checklists for different markets or trading styles, as the criteria and considerations may vary.

Q: What if a trade meets most of the checklist criteria but not all?

A: It's generally advisable to avoid trades that don't meet all of your checklist criteria, as this can increase your risk of losses.

Q: Is a trading checklist a guarantee of profits?

A: No, a trading checklist is not a guarantee of profits, but it can significantly improve your trading performance by helping you stay disciplined, consistent, and focused.

Conclusion of How to Create a Simple Trading Checklist

Creating and consistently using a simple trading checklist can be a game-changer for any trader, regardless of experience level. By establishing clear criteria, managing risk effectively, and staying disciplined, you can significantly improve your trading performance and achieve your financial goals. Start building your checklist today and take control of your trading journey. Remember to take advantage of the benefits offered by FBS.

```

0 Reviews

Your rating