Imagine turning a single ten-dollar bill into a thriving trading portfolio. Sounds like a pipe dream, right? Well, maybe not entirely. While it's not a get-rich-quick scheme, the world of trading offers possibilities, even for those starting with incredibly limited capital. This post explores how you can navigate the markets with a small account of $10 or less.

Many aspiring traders find themselves stuck before they even begin. The perception is that you need thousands of dollars to participate, leaving those with smaller budgets feeling excluded. Concerns about high commissions, minimum deposit requirements, and the sheer difficulty of generating meaningful returns with such a small amount can be discouraging. It feels like an impossible hurdle to overcome, a financial gatekeeping that keeps them on the sidelines.

This article aims to demystify trading with a small account. We'll delve into strategies, platforms, and risk management techniques that can help you make the most of your limited funds. We'll explore the challenges and opportunities, providing practical guidance to help you start your trading journey, even with just $10.

In essence, trading with a small account boils down to strategy, discipline, and understanding the risks involved. We will discuss micro-accounts, high-leverage opportunities, and the importance of choosing the right assets. The goal isn't necessarily to become a millionaire overnight, but rather to learn the ropes, develop your skills, and potentially grow your account over time. Key terms include: micro-trading, leverage, risk management, small account strategies, and trading platforms for beginners.

Embracing the Micro-Trading Mindset

My own foray into the world of trading started with a similarly small amount. Fresh out of college, I had more enthusiasm than capital. I remember depositing a meager $20 into a micro-account, feeling both excited and utterly terrified. The initial trades were, to put it mildly, a learning experience. I made mistakes, chased losses, and quickly learned the importance of discipline. But those early losses were invaluable lessons, teaching me about risk management and the psychology of trading. The key was to treat it as a learning opportunity, not a quick path to riches. I focused on understanding market movements, testing different strategies, and gradually refining my approach. The small account forced me to be incredibly selective with my trades, focusing on high-probability setups and avoiding impulsive decisions. This experience taught me that consistent, small gains are far more sustainable than chasing home runs. Even with a small account, you can build a solid foundation of knowledge and experience that will serve you well in the long run. Trading with a small account necessitates a shift in mindset. It's not about making huge profits quickly; it's about consistent, incremental growth. Focus on mastering the fundamentals, developing a solid strategy, and managing your risk effectively. This approach will not only help you preserve your capital but also lay the groundwork for future success as you scale your trading endeavors.

Understanding Micro-Accounts and Leverage

Micro-accounts are specifically designed for traders with small capital. They allow you to trade with smaller contract sizes, reducing the financial risk per trade. This is crucial when you only have $10 to work with. Leverage, on the other hand, is a double-edged sword. It amplifies both your potential profits and your potential losses. While it can seem tempting to use high leverage to maximize your returns, it's essential to use it cautiously, especially with a small account. Over-leveraging can quickly wipe out your entire capital if the market moves against you. Think of leverage as a magnifying glass. It can help you see things more clearly, but it can also burn you if you're not careful. The key is to use leverage responsibly, understanding the potential risks and rewards. Micro-accounts and leverage are tools, and like any tool, they can be used effectively or ineffectively. When used responsibly, they can provide a valuable opportunity to learn and grow as a trader, even with limited capital. Understanding the nuances of micro-accounts and leverage is paramount for success when trading with a small account. Choose brokers that offer micro-accounts with reasonable leverage options. Practice risk management techniques, such as setting stop-loss orders, to protect your capital. Remember that slow and steady wins the race.

The History and Myth of Small Account Trading

The idea of trading with a small account has been around for years, often fueled by stories of individuals who turned meager investments into fortunes. While these stories can be inspiring, it's crucial to separate fact from fiction. The reality is that consistent profitability in trading is challenging, regardless of the size of your account. The history of small account trading is filled with both successes and failures. Many have attempted it, but few have achieved lasting success. This is due to a combination of factors, including lack of discipline, poor risk management, and unrealistic expectations. One myth is that high leverage is the key to success with a small account. While leverage can amplify your returns, it also significantly increases your risk. Another myth is that you can get rich quickly by trading with a small account. This is simply not true. Trading requires patience, discipline, and a willingness to learn from your mistakes. The reality of small account trading is that it's a marathon, not a sprint. It's about consistent, incremental growth, not about hitting the jackpot. By understanding the history and dispelling the myths surrounding small account trading, you can approach it with a more realistic and informed perspective. This will help you avoid common pitfalls and increase your chances of success.

The Hidden Secrets of Risk Management with $10

The biggest secret to trading with a small account isn't some magical indicator or hidden strategy; it's meticulous risk management. With only $10, every trade carries significant weight. You can't afford to lose a substantial portion of your capital on a single trade. This means setting tight stop-loss orders, diversifying your trades (if possible), and avoiding over-leveraging. Risk management is about protecting your capital and ensuring that you can stay in the game long enough to learn and grow. Think of it as building a shield around your account, protecting it from the unpredictable forces of the market. Another secret is to focus on high-probability setups. Don't chase every opportunity that comes along. Instead, wait for the right conditions, where the odds are in your favor. This requires patience and discipline, but it's essential for preserving your capital. The hidden secrets of risk management with a small account are not glamorous or exciting, but they are the foundation of sustainable success. By prioritizing risk management, you can protect your capital, learn from your mistakes, and gradually build a profitable trading strategy. Remember, it's not about how much you make on each trade; it's about how much you keep.

Recommendations for Platforms and Strategies (Affiliate Link: https://affs.click/CANq3 - XM Broker)

When starting with a small account, the choice of trading platform is crucial. Look for brokers that offer micro-accounts, low minimum deposit requirements, and competitive commissions. Some popular options include XM Broker, which offer various account types suitable for beginners. In terms of strategies, focus on simple, easy-to-understand approaches. Avoid complex trading systems that require advanced technical analysis. One popular strategy for small accounts is scalping, which involves making small profits on short-term price movements. This requires quick reflexes and the ability to make decisions under pressure. Another strategy is trend following, which involves identifying and trading in the direction of the prevailing trend. This requires patience and the ability to ride out short-term fluctuations. Regardless of the strategy you choose, it's essential to backtest it thoroughly before risking real money. Backtesting involves simulating your strategy on historical data to see how it would have performed in the past. This can help you identify potential weaknesses in your strategy and make necessary adjustments. Choosing the right platform and strategy is essential for maximizing your chances of success with a small account. XM Broker offers a user-friendly platform and a variety of educational resources to help beginners get started. Remember to practice risk management and be patient. Trading is a skill that takes time and effort to develop.

Diving Deeper into Choosing the Right Assets for $10 Trading

Selecting the right assets to trade with a small account is critical. Focus on assets that offer high liquidity and low volatility. Highly liquid assets can be easily bought and sold without significantly impacting their price, while low volatility assets tend to have smaller price fluctuations, reducing the risk of large losses. Currency pairs like EUR/USD, USD/JPY, and GBP/USD are popular choices due to their high liquidity and relatively low volatility. These pairs are heavily traded, making it easier to enter and exit positions quickly. Another option is to consider trading indices, such as the S&P 500 or the Dow Jones Industrial Average. These indices represent a basket of stocks, which can diversify your risk and reduce the impact of individual stock movements. When trading indices, look for brokers that offer micro-contracts, which allow you to trade with smaller position sizes. It's also important to avoid trading highly volatile assets, such as penny stocks or cryptocurrencies, especially when you have a small account. These assets can experience large price swings, which can quickly wipe out your capital. Remember that trading with a small account requires patience and discipline. It's not about making quick profits; it's about consistent, incremental growth. Focus on selecting the right assets, managing your risk effectively, and sticking to your trading plan. This will increase your chances of success and help you build a profitable trading strategy over time.

Trading Psychology and the $10 Challenge

Trading psychology plays a significant role, especially when dealing with such a small amount. The pressure to succeed can lead to impulsive decisions, overtrading, and emotional distress. Recognizing and managing your emotions is crucial. It's easy to get caught up in the excitement of potential profits or the fear of losses. However, emotional trading often leads to poor decisions. Develop a trading plan and stick to it, regardless of your emotions. This will help you avoid making impulsive trades and stay focused on your long-term goals. Another important aspect of trading psychology is to accept losses as part of the process. No trading strategy is perfect, and you will inevitably experience losing trades. The key is to learn from your mistakes and not let them discourage you. Don't chase losses or try to recoup them quickly. This often leads to even bigger losses. Instead, take a break, analyze your mistakes, and come back with a fresh perspective. Trading with a small account can be challenging from a psychological perspective, but it can also be a valuable learning experience. It can teach you discipline, patience, and emotional control, which are essential skills for any successful trader. Remember to focus on the process, not just the outcome. Celebrate small victories and learn from your mistakes. This will help you build a positive mindset and stay motivated on your trading journey.

The Power of Compounding Small Gains with a Tiny Account

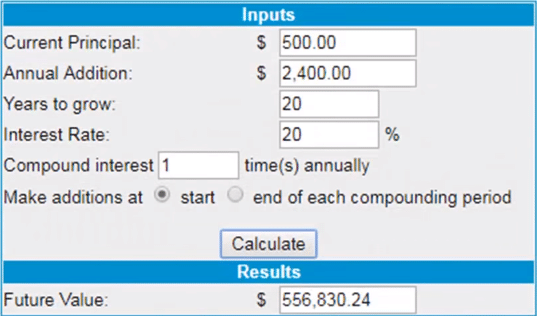

While it may seem impossible to make significant gains with just $10, the power of compounding should not be underestimated. Compounding is the process of reinvesting your profits to generate even more profits. Over time, even small gains can accumulate into substantial amounts. The key to compounding is consistency. You need to consistently generate profits and reinvest them into your account. This requires patience and discipline. Don't expect to get rich overnight. It takes time and effort to build a significant account balance through compounding. To illustrate the power of compounding, consider a scenario where you consistently generate a 1% profit per day on your $10 account. After one year, your account balance would have grown to over $377, assuming you reinvested all your profits. While this is a simplified example, it demonstrates the potential of compounding small gains over time. Of course, generating consistent profits is easier said than done. It requires a solid trading strategy, effective risk management, and a disciplined mindset. However, the power of compounding is a powerful motivator for traders with small accounts. It shows that even with limited capital, it is possible to achieve significant growth over time. Remember to focus on the long-term and be patient. Compounding is a slow and steady process, but it can yield remarkable results.

Fun Facts About Trading and Financial Markets

Did you know that the New York Stock Exchange (NYSE) was founded in 1792 under a buttonwood tree? Or that the term "bull market" comes from the way a bull attacks, thrusting its horns upward, while "bear market" comes from the way a bear swipes its paws downward? These are just a few of the many fascinating facts about trading and financial markets. Trading and financial markets have a rich history, filled with colorful characters, dramatic events, and intriguing anecdotes. The first stock exchange was established in Amsterdam in the early 17th century. The tulip mania of the 1630s is one of the most famous examples of a speculative bubble in history. The Great Depression of the 1930s had a profound impact on financial markets around the world. These events have shaped the way we trade and invest today. Understanding the history of trading and financial markets can provide valuable insights into the dynamics of the market and help you make more informed trading decisions. It can also make trading more engaging and enjoyable. So, take some time to learn about the history of the financial markets. You might be surprised at what you discover. From the buttonwood tree to the tulip mania, the history of trading and financial markets is full of fascinating stories and valuable lessons.

How to Practice Risk Management When You Only Have $10

Risk management is absolutely critical when you're trading with a small account. With only $10, you simply can't afford to take big risks. Every trade needs to be carefully considered, and you need to have a clear exit strategy in place. Start by determining your maximum risk per trade. A general rule of thumb is to risk no more than 1-2% of your account balance on a single trade. In this case, that would be 10-20 cents per trade. This may seem like a small amount, but it's important to protect your capital. Set stop-loss orders to automatically exit a trade if it moves against you. A stop-loss order is an order to sell an asset when it reaches a certain price. This helps limit your potential losses. Diversify your trades, if possible. Don't put all your eggs in one basket. Spread your risk across multiple assets. This can help reduce the impact of any single losing trade. Avoid over-leveraging your account. Leverage can amplify your profits, but it can also amplify your losses. Use leverage cautiously, especially when you have a small account. Monitor your trades closely and be prepared to adjust your strategy if necessary. The market is constantly changing, and you need to be flexible and adaptable. Practice risk management consistently, even when you're winning. It's easy to get complacent when you're on a winning streak, but that's when you're most vulnerable to making mistakes. Remember, risk management is not about avoiding losses altogether; it's about minimizing your losses and protecting your capital so that you can stay in the game long enough to learn and grow.

What If You Lose All Your $10?

Losing your initial $10 is a real possibility, and it's important to be prepared for it. While it might feel discouraging, it's crucial to view it as a learning experience rather than a complete failure. Many successful traders have blown through multiple accounts before finding consistency. Analyze what went wrong. Did you over-leverage? Did you ignore your stop-loss orders? Did you trade emotionally? Understanding your mistakes is the first step to improving. Don't be afraid to paper trade for a while. Paper trading allows you to practice your trading strategy without risking real money. This can help you build confidence and refine your skills. Consider starting with a demo account to hone your skills before depositing any real money. Focus on learning from your mistakes and developing a solid trading plan. Don't be discouraged if you lose your initial capital. Trading is a challenging endeavor, and it takes time and effort to develop a profitable strategy. Remember that even experienced traders experience losing streaks. The key is to stay disciplined, manage your risk effectively, and learn from your mistakes. If you lose your $10, don't give up. Take a break, analyze what went wrong, and come back with a new strategy and a renewed commitment to learning. Trading is a marathon, not a sprint, and it takes time and perseverance to achieve success.

Listicle: 5 Strategies for Trading with $10 or Less

Here are five strategies that can be effective when trading with a very small account:

- High-Leverage Forex Trading: While risky, some brokers offer high leverage on Forex pairs. Use this sparingly and with tight stop-loss orders.

- Micro-Investing Apps: Apps like Robinhood (though commission structures may vary) allow you to buy fractional shares of stocks, enabling participation even with small amounts.

- Binary Options (Use with Caution): Binary options offer fixed payouts, but they are highly speculative and can be very risky. Only risk a small portion of your capital per trade.

- Trading Cryptocurrency CFDs: CFDs (Contracts for Difference) allow you to speculate on the price movements of cryptocurrencies without owning the underlying asset.

- Focusing on News Events: Capitalize on news-driven volatility by trading assets that are likely to be affected by specific news announcements.

Remember that no strategy guarantees success, and risk management is always paramount, especially with limited capital. Research and understand each strategy thoroughly before putting it into practice. Be disciplined and stick to your trading plan. Don't let emotions cloud your judgment. Trading with a small account requires patience, discipline, and a willingness to learn from your mistakes. Don't expect to get rich overnight. It takes time and effort to develop a profitable strategy. Always prioritize risk management and protect your capital.

Question and Answer

Q: Can I really make money trading with only $10?

A: Yes, it's possible, but highly unlikely to become wealthy quickly. The goal is to learn and grow your account slowly, not to get rich fast.

Q: What's the best platform for trading with such a small amount?

A: Look for brokers with micro-accounts, low minimum deposits, and low commissions. Some options include XM Broker.

Q: What are the biggest risks when trading with $10?

A: Over-leveraging, emotional trading, and lack of a proper risk management strategy.

Q: What should I trade with such a small account?

A: Focus on highly liquid assets with low volatility, such as major currency pairs or indices with micro-contracts.

Conclusion of How to Trade with a Small Account ($10 or Less)

Trading with a small account of $10 or less is a challenging but potentially rewarding endeavor. It requires a strong understanding of risk management, a disciplined approach, and a willingness to learn from your mistakes. While it's unlikely to make you rich overnight, it can be a valuable way to gain experience in the financial markets and develop your trading skills. Focus on choosing the right platform, selecting appropriate assets, and managing your risk effectively. Remember that success in trading requires patience, perseverance, and a commitment to continuous learning. Before starting, explore resources like XM for potentially helpful educational material.

0 Reviews

Your rating