Navigating the world of Forex trading can feel like deciphering a foreign language, especially when you’re dealing with complex calculations. But what if I told you there's a tool that can simplify the process, allowing you to make informed decisions without getting bogged down in numbers? A Forex calculator could be your secret weapon to trading success.

Many traders find themselves spending hours manually calculating potential profits, losses, margin requirements, and other crucial metrics. This not only eats into valuable trading time but also increases the risk of errors, which can lead to costly mistakes. The complexity of currency pairs and leverage can be overwhelming, leaving traders feeling uncertain about their strategies.

This blog post will guide you on how to effectively use a Forex calculator. We'll explore its different functions, understand how it simplifies complex calculations, and demonstrate how it can become an indispensable tool in your Forex trading journey. Ready to empower your trading decisions? Let’s dive in!

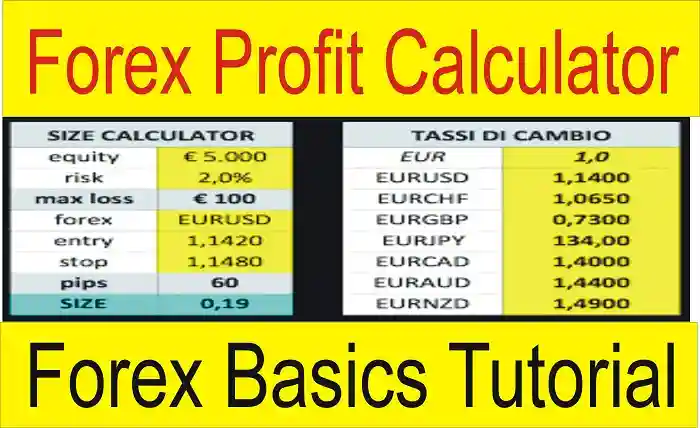

In essence, a Forex calculator is a specialized tool that performs various calculations related to currency trading, such as pip value, margin requirements, profit/loss, and currency conversions. By leveraging these tools, traders can efficiently analyze potential trades, manage risk effectively, and make well-informed decisions in the dynamic Forex market. Keywords related include: Forex calculators, Forex trading, Forex trading tools, Currency converter, Pip Calculator, Margin Calculator, Profit Calculator, Risk management.

How to Use a Forex Calculator for Pip Value

The target of understanding how to use a Forex Calculator for Pip Value is to accurately determine the monetary value of each pip movement in your chosen currency pair, allowing for better risk management and position sizing.

I remember vividly my early days in Forex trading. I was so excited to place my first trade, I completely overlooked calculating the pip value. I entered a position without fully understanding how much I stood to gain or lose per pip movement. As you can imagine, it didn't end well! I quickly realized the crucial role pip value calculations play in risk management. After that humbling experience, I started using a Forex calculator for pip value. It was a game-changer. It allowed me to quickly determine the potential profit or loss for each trade based on the pip movement, taking the guesswork out of risk management. This, in turn, gave me more confidence in my trades.

Calculating the pip value is crucial for traders to understand the potential risk and reward of a trade. A pip, or "percentage in point," represents the smallest price change that an exchange rate can make. The value of a pip varies depending on the currency pair, the lot size, and the exchange rate. A Forex calculator eliminates the manual effort and potential errors associated with calculating pip values. To use a pip value calculator, you typically need to input the currency pair you are trading, the lot size (e.g., standard, mini, micro), and the current exchange rate. The calculator will then provide the pip value in your account currency, allowing you to assess the potential profit or loss per pip movement. Accurately determining pip value empowers traders to set appropriate stop-loss and take-profit levels, manage risk effectively, and make informed decisions about position sizing.

Understanding Forex Calculator Functions

Forex calculators aren’t just for pip values; they offer a range of functionalities vital for successful trading. These functions include margin calculation, profit/loss estimation, currency conversion, and more.

At its core, a Forex calculator automates the mathematical tasks necessary for making sound trading decisions. It eliminates the need for manual calculations, reducing the chance of human error. A margin calculator, for instance, helps traders determine the amount of capital required to open and maintain a position, considering factors like leverage and account currency. This is crucial for avoiding margin calls and ensuring sufficient funds to cover potential losses. A profit/loss calculator allows you to estimate potential gains or losses based on entry and exit prices, lot size, and currency pair. This aids in evaluating the risk-reward ratio of a trade before placing it. A currency converter provides real-time exchange rates, essential when dealing with pairs involving currencies different from your account currency. Some Forex calculators also include features like Fibonacci calculators, pivot point calculators, and position size calculators, further enhancing their utility. Overall, understanding and utilizing these functions is a vital step toward making informed and profitable Forex trading decisions. Forex calculators are a cornerstone tool in the arsenal of both beginner and experienced traders.

The History and Myth of Forex Calculators

While the concept of Forex calculators as we know them today is relatively modern, the need for calculating currency values and profits has existed for centuries.

Historically, traders relied on manual calculations and conversion tables to assess currency values and profit potential. This was a time-consuming and error-prone process, especially with the increasing complexity of global markets. With the advent of computers and the internet, the development of automated Forex calculators became possible. Early versions were simple spreadsheets, but as technology advanced, so did the sophistication of these tools. Myths surrounding Forex calculators often involve the belief that they can guarantee profits. It's important to understand that while calculators can provide valuable insights and estimations, they are not a substitute for sound trading strategies, risk management, and market knowledge. Forex calculators are tools that, when used wisely, can enhance a trader's decision-making process. They provide accurate data based on the inputs provided, but the interpretation and application of that data ultimately lie with the trader. The historical progression of Forex calculations reflects the broader evolution of trading technology, from manual processes to sophisticated automated tools designed to empower traders in the fast-paced Forex market. They are a tool, not a magic bullet, that requires skill, understanding, and disciplined application to be truly effective.

Unveiling the Hidden Secret of How to Use a Forex Calculator

The real secret to effectively using a Forex calculator isn’t just about inputting numbers; it’s about understanding what those numbers mean and how they impact your trading strategy.

Many traders treat Forex calculators as simple number-crunching tools, focusing solely on the output without fully grasping the underlying principles. The hidden secret lies in using the calculator as a learning tool. By experimenting with different values and scenarios, you can gain a deeper understanding of how factors like leverage, margin, and pip value affect your trades. For instance, playing with different lot sizes and leverage levels in a margin calculator can illustrate the potential impact on your account balance. Similarly, using a profit/loss calculator to analyze past trades can reveal valuable insights into your trading performance and help you identify areas for improvement. Another crucial aspect is understanding the assumptions built into the calculator. Most calculators assume constant exchange rates, which is rarely the case in the real world. Therefore, it’s essential to interpret the results cautiously and factor in potential market volatility. The hidden secret, then, is to use the Forex calculator not just as a quick fix but as a tool for enhancing your understanding of the Forex market and improving your trading skills. This deeper comprehension will ultimately lead to more informed and successful trading decisions.

Recommendations: Using a Forex Calculator with XM Broker

My recommendation is to integrate a Forex calculator into your trading routine to enhance your risk management and decision-making processes. It’s a simple but powerful way to refine your approach.

As an experienced trader, I've found that using a reliable Forex calculator alongside a trusted broker like XM Broker can significantly improve your trading outcomes. XM Broker offers a robust platform with a variety of trading tools and resources. Combining this with the precision of a Forex calculator can give you a competitive edge. For example, before opening a position, use the Forex calculator to determine the margin requirements. This will help you ensure you have sufficient funds in your account to cover potential losses. Secondly, calculate the pip value for your chosen currency pair. This will help you accurately determine the amount you stand to gain or lose per pip movement, enabling you to set appropriate stop-loss and take-profit levels. Use the profit/loss calculator to estimate the potential outcome of your trade based on your target entry and exit prices. This will help you evaluate the risk-reward ratio and decide whether the trade aligns with your trading plan. Finally, use the currency converter to understand the value of your trades in your account currency. This can be particularly useful when trading currency pairs that don't include your account currency. By integrating these tools into your workflow, you'll be better equipped to manage risk, make informed decisions, and potentially increase your trading profitability.

Step-by-Step Guide: Using a Forex Calculator

Using a Forex calculator can seem straightforward, but understanding each step ensures accurate results and informed decisions. Let's break it down.

First, identify the type of calculation you need. Are you calculating pip value, margin requirements, profit/loss, or something else? Different calculators cater to different needs. Next, select a reliable Forex calculator. Many online tools are available, but ensure the source is reputable and provides accurate data. Enter the required information. This typically includes currency pair, lot size, leverage (if applicable), entry price, and exit price. Double-check the accuracy of your inputs to avoid errors in the results. Review the output. The calculator will provide the results based on the information you provided. Take the time to understand what the numbers mean and how they impact your trading strategy. Adjust your trading parameters accordingly. If the results of the calculator indicate a high-risk trade, consider adjusting your position size, leverage, or stop-loss levels. Document your calculations. This will help you track your trading decisions and analyze your performance over time. Remember that Forex calculators are tools to aid decision-making, not replace it. Use your knowledge of the market and your trading strategy in conjunction with the calculator results to make informed decisions. The power of a Forex calculator lies in its ability to quickly and accurately perform complex calculations, allowing you to focus on the strategic aspects of trading.

Forex Calculator: Tips and Tricks

Mastering Forex calculators involves more than just knowing how to use them; it's about employing clever strategies to maximize their utility.

One helpful tip is to use multiple calculators from different sources to cross-validate your results. Discrepancies can highlight potential errors in your inputs or issues with the calculator itself. Another useful trick is to create a spreadsheet where you can record your calculations and track the results over time. This will allow you to analyze your trading performance and identify patterns that can inform your future decisions. Also, familiarize yourself with the limitations of each calculator. For example, most calculators assume fixed exchange rates, which is rarely the case in the real world. Consider the potential impact of market volatility on your calculations. Experiment with different scenarios. Play with the inputs to see how changes in leverage, lot size, and entry prices affect your potential profits and losses. This will help you develop a better understanding of risk management. Don't solely rely on Forex calculators for your trading decisions. Use them in conjunction with your market analysis and trading strategy to make informed choices. Remember that Forex calculators are tools to enhance your trading, not replace your judgment. Incorporating these tips and tricks into your routine can help you get the most out of Forex calculators and improve your trading performance.

Advanced Techniques: Maximizing Forex Calculator Usage

To truly master Forex calculators, explore advanced techniques that leverage their capabilities to enhance your trading strategy.

One advanced technique is to use a Forex calculator in conjunction with a trading simulator. This allows you to test different trading strategies in a risk-free environment and see how the calculator's results align with actual market movements. Another technique is to integrate the calculator with your trading platform. Some platforms offer built-in calculators or allow you to integrate third-party tools, streamlining your workflow. Another approach is to use the calculator to backtest your trading strategy. By inputting historical data, you can see how your strategy would have performed under different market conditions. You can also use the calculator to identify potential trading opportunities. For example, a pip value calculator can help you determine the potential profit from a small price movement, allowing you to capitalize on short-term trends. Understand the specific formulas used by the calculator. This will give you a deeper understanding of how the results are derived and allow you to interpret them more effectively. Combining these advanced techniques with your existing trading knowledge can significantly enhance your trading performance and improve your overall profitability.

Fun Facts About Forex Calculators

Did you know that the first Forex calculators were likely simple spreadsheets used by traders to manually calculate profit and loss? The evolution is fascinating!

One fun fact is that some of the earliest Forex calculators were actually coded in BASIC, a programming language popular in the 1970s and 1980s. These early calculators were far less sophisticated than the tools we have today, but they laid the groundwork for the development of modern Forex calculators. Another fun fact is that many professional Forex traders still use custom-built calculators tailored to their specific trading strategies. These calculators often incorporate complex algorithms and data analysis techniques to provide highly accurate and personalized results. Did you know that the accuracy of a Forex calculator depends on the accuracy of the data it uses? Even the most sophisticated calculator can produce misleading results if it's using outdated or inaccurate exchange rates. The development of Forex calculators has paralleled the evolution of the Forex market itself. As the market has become more complex and competitive, so too have the tools that traders use to navigate it. Forex calculators have democratized access to complex financial calculations, enabling even novice traders to make informed decisions. These tools have transformed the Forex market by leveling the playing field and empowering traders of all skill levels to participate effectively.

How to Choose the Right Forex Calculator

Choosing the right Forex calculator can be the difference between making informed decisions and relying on inaccurate information. Here's what to consider.

First, consider your specific needs. What types of calculations do you need to perform most frequently? A simple pip value calculator may suffice for some traders, while others may require a more comprehensive tool with multiple functions. Look for a calculator with a user-friendly interface. A cluttered or confusing interface can make it difficult to input data and interpret the results. The calculator should also be accurate and reliable. Check reviews and testimonials from other traders to ensure that the calculator provides consistent and accurate results. Consider whether the calculator offers real-time data. A calculator that uses outdated exchange rates will provide inaccurate results. Check for compatibility with your trading platform. A calculator that can be integrated with your platform can streamline your workflow and save you time. Consider the cost of the calculator. Some calculators are free, while others require a subscription fee. Weigh the benefits of a paid calculator against the cost to determine if it's worth the investment. Also, check for support and documentation. A calculator with good support and clear documentation will be easier to use and troubleshoot if you encounter any issues. The right Forex calculator is an invaluable tool for making informed trading decisions and improving your overall profitability.

What if Forex Calculators Disappear?

Imagine a world without Forex calculators. How would traders adapt, and what would the impact be on the market?

In the absence of Forex calculators, traders would be forced to rely on manual calculations and spreadsheets. This would increase the time and effort required to make trading decisions and would also increase the risk of errors. The impact on the market would likely be significant. Trading volumes could decrease as traders become more cautious and hesitant to enter positions without the aid of calculators. Market volatility could increase as traders make less informed decisions. The ability to quickly and accurately assess risk would be diminished, potentially leading to greater losses for individual traders and increased systemic risk for the market as a whole. The rise of automated trading systems and algorithmic trading strategies could be hampered as these systems rely heavily on the data and calculations provided by Forex calculators. The Forex market is a fast-paced and dynamic environment, and Forex calculators are essential tools for navigating its complexities. Without them, traders would face significant challenges, and the market would likely become less efficient and more volatile. The loss of Forex calculators would be a major setback for the Forex trading community. The reliance on these tools underscores the importance of technology in modern finance and highlights the critical role they play in facilitating informed decision-making and efficient market operations.

Listicle: Top 5 Reasons to Use a Forex Calculator

Here are the top 5 reasons why every Forex trader should be using a Forex calculator:

1.Accurate Pip Value Calculations: Determine the monetary value of each pip movement for precise risk management.

2.Efficient Margin Assessment: Understand the capital required to open and maintain positions, avoiding margin calls.

3.Informed Profit/Loss Estimation: Evaluate potential gains or losses based on entry and exit prices for better decision-making.

4.Simplified Currency Conversion: Convert currency values quickly and accurately, especially for pairs not involving your account currency.

5.Enhanced Risk Management: Set appropriate stop-loss and take-profit levels, reducing the potential for significant losses. Using a Forex calculator can significantly enhance your trading performance and improve your overall profitability. These tools provide accurate and reliable data that empowers you to make informed decisions and manage risk effectively. Integrate a Forex calculator into your trading routine today to unlock its full potential and elevate your trading success. These reasons illustrate how a Forex calculator streamlines essential tasks, making complex calculations accessible to traders of all levels and solidifying its place as an indispensable tool in the Forex market. The benefits extend beyond mere convenience; they directly contribute to improved risk management, better-informed decisions, and ultimately, greater potential for profitability.

Question and Answer Section: How to Use a Forex Calculator

Let's address some common questions about using Forex calculators to ensure you're making the most of this valuable tool.

Q: What is a pip and why is it important to calculate its value?

A: A pip (percentage in point) is the smallest price change an exchange rate can make. Calculating its value helps you understand the potential profit or loss per pip movement, essential for risk management.

Q: How does leverage affect margin requirements?

A: Higher leverage allows you to control larger positions with less capital but also increases the risk. A margin calculator helps you determine the required margin based on your leverage and position size, preventing margin calls.

Q: Can a Forex calculator guarantee profits?

A: No, a Forex calculator is a tool to aid decision-making, not a crystal ball. It provides accurate data based on your inputs, but success depends on your trading strategy, market knowledge, and risk management skills.

Q: Where can I find a reliable Forex calculator?

A: Many reputable financial websites and brokers offer Forex calculators. Look for calculators with positive reviews and real-time data. Always cross-validate results from multiple sources to ensure accuracy.

Conclusion of How to Use a Forex Calculator

In conclusion, understanding and effectively utilizing a Forex calculator is paramount for success in the Forex market. From calculating pip values to assessing margin requirements and estimating profit/loss, these tools empower traders to make informed decisions, manage risk effectively, and navigate the complexities of currency trading with confidence. While not a substitute for sound trading strategies and market knowledge, a Forex calculator serves as an invaluable aid in enhancing your trading prowess. Consider checking out Headway as a next step in your forex journey!

0 Reviews

Your rating