Imagine watching a rollercoaster climb to its peak, the anticipation building with each click and clack. That's kind of like the moments leading up to a major news release in the trading world. The potential for exhilarating highs or terrifying drops is palpable. But is it a ride worth taking, or are you better off watching from the sidelines?

Many traders find themselves caught in the whirlwind of volatility that news releases bring. The rapid price fluctuations, the potential for slippage, and the overall uncertainty can lead to missed opportunities, unexpected losses, and a general sense of frustration. It's like trying to navigate a crowded dance floor blindfolded – you might get lucky, but you're more likely to step on someone's toes.

The question of whether youshouldtrade during news releases is a complex one with no easy answer. It depends heavily on your trading style, risk tolerance, and level of experience. Some traders thrive on the volatility and see it as a chance to profit, while others prefer to avoid the chaos and wait for the market to stabilize. Ultimately, the decision is a personal one that should be based on careful consideration and a well-defined trading strategy.

This article will delve into the heart of trading during news releases, exploring the potential benefits and risks. We'll uncover the strategies used by seasoned traders, debunk common myths, and offer practical advice to help you make an informed decision about whether or not to participate in this high-stakes game. We'll cover key concepts like volatility, market sentiment, economic indicators, and risk management, all crucial for navigating the choppy waters of news trading.

Understanding News Release Volatility

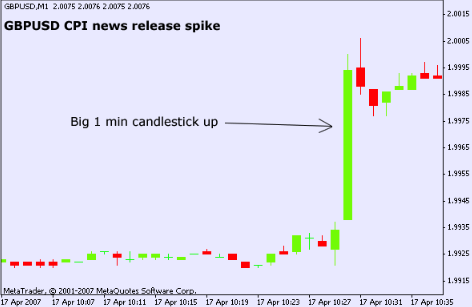

I remember once thinking I was a genius during a non-farm payroll (NFP) release. The price shot up, I jumped in thinking it would continue and...bam! It reversed almost immediately, taking a chunk out of my capital. That day taught me a valuable lesson about volatility. News releases create artificial volatility; algorithms react in milliseconds to headlines, triggering stop losses and creating whipsaws. It's less about fundamental analysis at that moment and more about algorithmic warfare. To trade effectively during news releases, you need to understand the drivers of this volatility: market expectations, the actual figures released, and the subsequent interpretation by major players. The market often "prices in" expectations before the release, so a seemingly "good" number might actually cause a sell-off if it doesn't exceed expectations by a significant margin. Understanding this dynamic is crucial. Think of it as a game of poker; you need to know your opponents (the algorithms and other traders) and anticipate their moves. Understanding the expected range and potential impact of the news release is vital to determine whether the potential reward justifies the risk.

What is News Release Trading?

News release trading is a strategy where traders attempt to profit from the immediate price fluctuations that occur following the release of significant economic or financial news. These releases can include things like inflation data, employment figures (like the non-farm payroll), interest rate decisions by central banks, GDP growth numbers, and major corporate earnings reports. The idea is that these announcements can significantly alter market sentiment and lead to rapid price movements in currencies, stocks, commodities, and other assets. This strategy requires a deep understanding of market dynamics, economic calendars, and the potential impact of different types of news on various asset classes. Traders who engage in news release trading typically employ various techniques, including scalping (taking small profits from rapid price swings), breakout strategies (entering positions when prices break through key levels), and hedging strategies (to mitigate risk). However, it's important to recognize that news release trading is inherently risky due to the potential for high volatility, slippage, and unexpected market reactions. Successful news traders often have access to real-time news feeds, advanced charting platforms, and robust risk management systems. Before engaging in news release trading, carefully consider whether your risk tolerance aligns with potential outcomes.

History and Myths of News Release Trading

The history of news release trading is intertwined with the evolution of financial markets and the increasing availability of information. In the past, before the internet, traders relied on slower methods of information dissemination, creating opportunities for those with faster access. Today, technology has leveled the playing field, but myths still persist. One common myth is that news release trading is a guaranteed path to quick riches. While significant profits are possible, losses can be equally substantial. Another myth is that you can accurately predict the market's reaction to a news release. While you can analyze historical data and market expectations, the actual outcome is often unpredictable due to factors like algorithmic trading, market sentiment, and unexpected events. A deeper look reveals that news release trading has evolved from a game of speed and access to a more sophisticated game of analysis, risk management, and understanding algorithmic behavior. News release trading also has ties to the "tape readers" of the early 20th century who would attempt to predict market movements based on the flow of information on ticker tape. Today's news release traders use similar techniques, but with the benefit of modern technology and data analysis tools. Understanding the history helps to dispel the myths and provide a more realistic perspective on the challenges and opportunities.

Hidden Secrets of News Release Trading

The real "secrets" of news release trading aren't about insider information or foolproof strategies, but rather about disciplined risk management, psychological control, and a deep understanding of market mechanics. One often-overlooked secret is the importance of pre-release preparation. This involves analyzing historical data, understanding market expectations, and developing a detailed trading plan with clear entry and exit points. Another secret is the ability to stay calm and rational in the face of rapid price fluctuations. Fear and greed can lead to impulsive decisions, which are often costly. Successful news traders also understand the role of algorithmic trading and how algorithms react to different types of news releases. They learn to identify patterns and anticipate potential market reactions. Furthermore, it's crucial to recognize that not all news releases are created equal. Some releases have a greater impact on the market than others, depending on factors like the economic climate, market sentiment, and the credibility of the data source. Identifying which releases are worth trading and which ones to avoid is an essential skill. Finally, the biggest secret is continuous learning and adaptation. The market is constantly evolving, and successful traders must be willing to adjust their strategies and techniques to stay ahead of the game. Remember, experience is the best teacher; consistently analyze your trades and learn from your mistakes to develop a winning approach.

Recommendation of News Release Trading

If you're considering trading during news releases, proceed with extreme caution. Start with a demo account to practice your strategies and familiarize yourself with the market's behavior. Never risk more than you can afford to lose, and always use stop-loss orders to limit your potential losses. Consider starting with smaller positions to reduce your risk exposure. Also, choose a broker that offers fast execution speeds and minimal slippage, as these factors can significantly impact your profitability. XM Broker offers this and other features that are helpful for traders. Before each trade, carefully analyze the news release and understand its potential impact on the market. Develop a detailed trading plan with clear entry and exit points, and stick to your plan even if the market moves against you. Be aware of the potential for false breakouts and whipsaws, and avoid chasing prices. Don't be afraid to sit on the sidelines if you're unsure about the market's direction. Remember, patience and discipline are key to success in news release trading. If you find yourself feeling overwhelmed or stressed, take a break and step away from the market. Trading should be a rational and calculated activity, not an emotional rollercoaster. Above all, prioritize risk management and protect your capital. News release trading can be a profitable strategy, but it requires skill, experience, and a disciplined approach.

The Role of Economic Calendars

Economic calendars are an indispensable tool for anyone considering trading during news releases. These calendars provide a comprehensive list of upcoming economic events, including the date, time, and type of release. They also often include estimates or forecasts for the expected figures, allowing traders to anticipate potential market reactions. By using an economic calendar, you can plan your trading day and identify the specific news releases that are most likely to impact your chosen asset classes. Look for high-impact releases, such as those related to inflation, employment, and interest rates, as these tend to generate the most significant market volatility. Pay attention to the time zone displayed on the calendar and adjust it to your local time to ensure that you don't miss any important releases. In addition to the date and time, economic calendars often provide a brief description of the release and the agency responsible for publishing the data. Understanding the source of the data can help you assess its credibility and potential impact on the market. Before trading a particular news release, take some time to research its historical impact on the market. This can help you develop a better understanding of how the market is likely to react to the actual figures. Also, consider tracking the revisions to previous releases, as these can sometimes provide clues about the accuracy of the data and the potential for future surprises. A thorough understanding of economic calendars and the data they provide is essential for successful news release trading.

Tips for News Release Trading

Trading during news releases can be a lucrative venture if approached strategically. Here are some key tips to consider. First, prepare thoroughly by studying economic calendars and understanding the potential impact of different news events. Focus on high-impact releases that typically trigger significant market volatility. Second, have a clear trading plan with defined entry and exit points. Avoid impulsive decisions and stick to your plan, even if the market moves against you. Third, manage your risk effectively by using stop-loss orders to limit potential losses. Never risk more than you can afford to lose on a single trade. Fourth, be aware of the potential for slippage, which can occur during periods of high volatility. Choose a broker with fast execution speeds and minimal slippage. Fifth, consider using pending orders to enter the market at pre-determined levels. This can help you avoid chasing prices and improve your execution accuracy. Sixth, be patient and wait for the market to confirm your bias before entering a trade. Avoid getting caught up in the initial hype and wait for a clear signal. Seventh, don't be afraid to sit on the sidelines if you're unsure about the market's direction. Sometimes, the best trade is no trade. Eighth, review and analyze your trades to identify areas for improvement. Learn from your mistakes and continuously refine your strategy. Ninth, be mindful of market sentiment and how it can influence price action. Pay attention to news headlines and social media trends. Tenth, be prepared for unexpected events and market surprises. News release trading is inherently unpredictable, so always have a contingency plan.

Using Technical Analysis in News Trading

While news release trading is heavily influenced by fundamental factors, technical analysis can play a valuable role in confirming your trading decisions and identifying potential entry and exit points. Look for key support and resistance levels, trendlines, and chart patterns that may coincide with the expected market reaction to a news release. These technical levels can provide valuable clues about where the market is likely to move after the release. For example, if a price is approaching a key resistance level before a news release, a positive surprise in the data may trigger a breakout above that level, presenting a potential buying opportunity. Conversely, a negative surprise may cause the price to reverse and fall back below the resistance level, signaling a potential shorting opportunity. Additionally, technical indicators, such as moving averages, RSI, and MACD, can help you gauge the strength of the underlying trend and identify potential overbought or oversold conditions. These indicators can be used to confirm your bias and identify potential entry or exit points. For example, if a price is overbought according to the RSI indicator and a negative news release is expected, a shorting opportunity may present itself. However, it's important to remember that technical analysis should be used in conjunction with fundamental analysis when trading news releases. Don't rely solely on technical indicators, as they can be easily whipsawed by the volatility that typically accompanies news events. Instead, use technical analysis as a tool to confirm your trading decisions and improve your execution accuracy.

Fun Facts of News Release Trading

Did you know that the non-farm payroll (NFP) report, which measures the change in the number of employed people during the previous month, excluding the farming industry, is often referred to as "the mother of all economic indicators"? This is because it tends to have a significant impact on the financial markets, particularly the currency market. Another fun fact is that the market's reaction to a news release is not always logical. Sometimes, the market will move in the opposite direction of what you would expect based on the data. This can be due to factors like market sentiment, algorithmic trading, and pre-release positioning. It's also interesting to note that some traders specialize solely in news release trading, making a living from the volatility that accompanies these events. These traders often have access to advanced trading platforms, real-time news feeds, and sophisticated risk management systems. Furthermore, the advent of algorithmic trading has significantly changed the landscape of news release trading. Algorithms can react to news headlines in milliseconds, creating rapid price fluctuations and making it more difficult for human traders to compete. However, some traders have developed strategies to take advantage of these algorithmic movements. Finally, it's worth noting that news release trading is not for the faint of heart. It requires a high level of skill, experience, and discipline. It's also important to be prepared for losses, as not every trade will be a winner. However, with the right approach and a solid understanding of the market, news release trading can be a profitable and rewarding endeavor.

How to Trade News Releases?

Trading news releases involves a multi-step process, beginning with careful preparation and ending with disciplined execution. First, you must identify the news releases that are likely to impact your chosen asset classes. Use an economic calendar to track upcoming events and research their historical impact on the market. Second, develop a trading plan with clear entry and exit points. Consider using pending orders to enter the market at pre-determined levels. Third, manage your risk effectively by using stop-loss orders to limit potential losses. Never risk more than you can afford to lose on a single trade. Fourth, choose a broker that offers fast execution speeds and minimal slippage. This is particularly important during periods of high volatility. Fifth, monitor the news release closely and wait for the market to react. Avoid impulsive decisions and stick to your trading plan. Sixth, be aware of the potential for false breakouts and whipsaws. The market may initially move in one direction before reversing course. Seventh, consider using a breakout strategy, which involves entering a trade when the price breaks through a key support or resistance level. Eighth, be patient and wait for the market to confirm your bias before entering a trade. Avoid getting caught up in the initial hype. Ninth, review and analyze your trades to identify areas for improvement. Learn from your mistakes and continuously refine your strategy. Tenth, be prepared for unexpected events and market surprises. News release trading is inherently unpredictable, so always have a contingency plan.

What if You Trade During News Releases?

If you decide to trade during news releases, you're entering a world of heightened volatility and increased risk. The market can react unpredictably, and even the most seasoned traders can experience losses. One potential outcome is that you could profit handsomely from the rapid price movements, especially if you've correctly anticipated the market's reaction to the news. However, it's equally possible that you could suffer significant losses if the market moves against you. Slippage, which occurs when your order is filled at a price different from the one you requested, is a common problem during news releases. This can eat into your profits or exacerbate your losses. Another potential outcome is that you could experience emotional distress due to the stress and pressure of trading during volatile market conditions. Fear and greed can cloud your judgment and lead to impulsive decisions. It's also possible that you could develop a gambling mentality, chasing losses and taking unnecessary risks. Furthermore, you could become addicted to the adrenaline rush of trading during news releases, neglecting other aspects of your life. If you find yourself experiencing any of these negative outcomes, it's important to seek help from a qualified professional. Remember, trading should be a rational and calculated activity, not an emotional rollercoaster. If you're not prepared to handle the risks and potential downsides, it's best to avoid trading during news releases altogether. A good rule of thumb: only trade what you can afford to lose.

Listicle of News Release Trading

Here's a quick listicle summarizing key aspects of news release trading:

- Preparation is Key: Use economic calendars and understand potential market impact.

- Develop a Plan: Define entry/exit points, and stick to it.

- Manage Risk: Use stop-loss orders; don't over-leverage.

- Choose Broker Wisely: Fast execution, minimal slippage are crucial.

- Monitor Releases Closely: React to the market, not the hype.

- Beware False Breakouts: Patience is a virtue.

- Consider Breakout Strategies: Capitalize on price breaches.

- Confirm Your Bias: Wait for market validation.

- Review and Learn: Continuous improvement is essential.

- Expect the Unexpected: Have a contingency plan.

Question and Answer

Q: Is news release trading suitable for beginners?

A: Generally, no. News release trading requires experience, a deep understanding of market dynamics, and strong risk management skills. Beginners should focus on developing a solid foundation in trading fundamentals before attempting to trade news releases.

Q: What are the biggest risks of news release trading?

A: The biggest risks include high volatility, slippage, unexpected market reactions, emotional distress, and the potential for significant losses.

Q: What are some key strategies for managing risk in news release trading?

A: Key strategies include using stop-loss orders, never risking more than you can afford to lose, choosing a broker with fast execution speeds and minimal slippage, and developing a detailed trading plan with clear entry and exit points.

Q: How can I improve my news release trading skills?

A: You can improve your skills by studying economic calendars, researching the historical impact of news releases, practicing on a demo account, reviewing and analyzing your trades, and continuously refining your strategy.

Conclusion of Should You Trade During News Releases?

In conclusion, trading during news releases is a double-edged sword. It presents the potential for quick profits but also carries significant risks. If you're a seasoned trader with a solid understanding of market dynamics, a disciplined approach, and a robust risk management strategy, then it might be a worthwhile endeavor. However, if you're a beginner or risk-averse, it's generally best to avoid the chaos and wait for the market to stabilize. Remember to always prioritize risk management and protect your capital. For those looking to enhance their trading journey, consider exploring reputable platforms like Headway.

0 Reviews

Your rating