Ever felt like you're watching a secret language unfold on a trading screen? Numbers, symbols, and currencies flashing by, promising potential riches (or potential pitfalls!). If you've ever glanced at Forex trading and felt a twinge of curiosity mixed with utter bewilderment, you're not alone. It all starts with understanding the very foundation of Forex: currency pairs.

Trying to navigate the Forex market without understanding currency pairs is like trying to drive a car without knowing the difference between the gas pedal and the brake. You might stumble around for a bit, but you're likely to end up in a ditch, or worse. It's not enough to know that you're dealing with money; you need to understandhowthat money is being valued and traded against other currencies.

So, what exactlyarecurrency pairs in Forex? Simply put, a currency pair is a quotation of two different currencies, with the value of one currency being relative to the other. One currency is the base currency, and the other is the quote currency. When you trade Forex, you are essentially buying one currency and selling another simultaneously. Understanding this fundamental concept is the key to unlocking the potential, and avoiding the perils, of the foreign exchange market.

This article will unpack the concept of currency pairs, explaining their importance in Forex trading. We'll cover key terms like base and quote currencies, explore the major, minor, and exotic pairs, and delve into the factors that influence their fluctuations. We'll also touch upon trading strategies and offer valuable tips to help you navigate this complex but potentially rewarding market. Get ready to demystify the world of Forex, one currency pair at a time! Let's explore currency pairs, Forex trading strategies, base and quote currencies, major, minor, and exotic pairs, market influence, and trading tips.

Understanding Base and Quote Currencies

I remember my first attempt at Forex trading. Armed with a small amount of capital and a whole lot of naive enthusiasm, I jumped into the market without truly understanding what I was looking at. I saw a chart with "EUR/USD" plastered across the top and figured, "Okay, I know Euros and Dollars, this can't bethathard." The reality check came swiftly, and painfully, in the form of losing trades. It wasn't until I took a step back and focused on the basics, like understanding the roles of the base and quote currencies, that I started to see some improvement. The base currency is the first currency listed in a currency pair, while the quote currency is the second. The price of the currency pair indicates how much of the quote currency is needed to buy one unit of the base currency. For example, in EUR/USD, Euro is the base currency, and USD is the quote currency. If the EUR/USD price is 1.1000, it means that one Euro can be exchanged for

1.1000 US Dollars.

Understanding this relationship is fundamental. If you believe the base currency will increase in value relative to the quote currency, you would "buy" the pair, essentially betting that you can later sell the base currency for more of the quote currency. Conversely, if you believe the base currency will decrease in value, you would "sell" the pair, hoping to buy it back later at a lower price. Many factors influence currency pair values, including economic indicators, political events, and market sentiment. Keep abreast of these factors is critical to making informed trading decisions. Without this understanding, you're essentially gambling. Take the time to learn the language of Forex, starting with the vital roles of base and quote currencies, and you'll be well on your way to making more informed trading decisions. And always remember to manage your risk carefully; even the most seasoned traders experience losses.

Major, Minor, and Exotic Currency Pairs

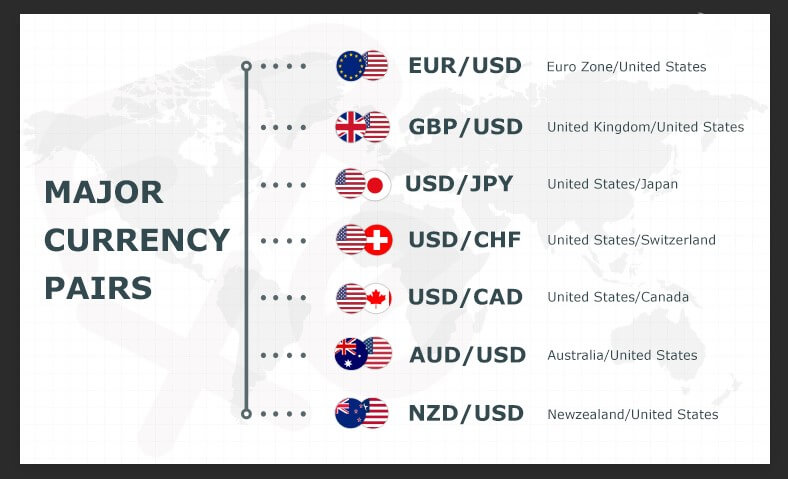

Currency pairs can be categorized into three main types: major, minor (or cross), and exotic. The major currency pairs are the most frequently traded pairs and involve the US dollar (USD) paired with another major currency. These include EUR/USD (Euro/US Dollar), USD/JPY (US Dollar/Japanese Yen), GBP/USD (British Pound/US Dollar), USD/CHF (US Dollar/Swiss Franc), AUD/USD (Australian Dollar/US Dollar), USD/CAD (US Dollar/Canadian Dollar), and NZD/USD (New Zealand Dollar/US Dollar). Major pairs are known for their high liquidity, tight spreads (the difference between the buying and selling price), and relatively stable volatility, making them popular choices for both beginner and experienced traders.

Minor currency pairs, also known as cross-currency pairs, do not involve the US dollar. They are combinations of other major currencies such as EUR/GBP (Euro/British Pound), EUR/JPY (Euro/Japanese Yen), and GBP/JPY (British Pound/Japanese Yen). While they offer opportunities for diversification, minor pairs generally have lower liquidity and wider spreads compared to major pairs. Exotic currency pairs involve pairing a major currency with a currency from an emerging market or smaller economy. Examples include USD/TRY (US Dollar/Turkish Lira), USD/MXN (US Dollar/Mexican Peso), and EUR/ZAR (Euro/South African Rand). Exotic pairs can be more volatile and have wider spreads than major and minor pairs, presenting both higher potential profits and higher risks. Trading exotic pairs requires a deeper understanding of the economic and political factors affecting the respective countries. Choose the pairs that best suit your risk tolerance and trading strategy.

The History and Myth of Currency Pairs

The history of currency pairs is intertwined with the history of international trade and finance. The Bretton Woods Agreement in 1944 established a system of fixed exchange rates, with the US dollar pegged to gold and other currencies pegged to the US dollar. This system provided stability but ultimately collapsed in the early 1970s, leading to the floating exchange rate system we have today. In a floating exchange rate system, currency values are determined by market forces of supply and demand.

There are also several myths surrounding currency pairs. One common myth is that certain currency pairs are "safer" than others. While major currency pairs tend to be more liquid and less volatile, they are still subject to market risks. Another myth is that technical analysis alone is sufficient for trading currency pairs. While technical analysis can be a valuable tool, it should be used in conjunction with fundamental analysis, which involves assessing economic indicators, political events, and other factors that can influence currency values. Additionally, many beginners believe that simply following the news or copying the trades of successful traders guarantees profits. While staying informed and learning from others is beneficial, it's crucial to develop your own trading strategy and risk management plan. Forex trading involves risks, and no strategy guarantees profits.

The Hidden Secrets of Currency Pairs

One of the hidden secrets of currency pairs is the influence of central banks. Central banks play a crucial role in managing their country's currency by setting interest rates, controlling the money supply, and intervening in the foreign exchange market. These actions can have a significant impact on currency values. For example, if a central bank raises interest rates, it can attract foreign investment, increasing demand for the currency and causing its value to appreciate. Conversely, if a central bank lowers interest rates, it can discourage foreign investment and cause the currency to depreciate.

Another hidden secret is the role of market sentiment. Market sentiment refers to the overall attitude or feeling of investors towards a particular currency or market. Positive sentiment can drive up the value of a currency, while negative sentiment can cause it to fall. Market sentiment can be influenced by various factors, including economic news, political events, and social media trends. Traders often use sentiment indicators, such as the Commitment of Traders (COT) report, to gauge market sentiment and make informed trading decisions. Finally, understanding the correlation between different currency pairs is vital. Some currency pairs tend to move in the same direction, while others move in opposite directions. By identifying these correlations, traders can diversify their portfolios and manage their risk more effectively.

Recommendation for Currency Pairs

Choosing the right currency pairs to trade depends on your risk tolerance, trading style, and knowledge of the market. For beginners, it's generally recommended to focus on the major currency pairs, such as EUR/USD, USD/JPY, and GBP/USD. These pairs have high liquidity, tight spreads, and relatively stable volatility, making them easier to trade and less prone to sudden price swings. Once you gain experience and knowledge, you can explore minor and exotic currency pairs.

Before trading any currency pair, it's essential to conduct thorough research and analysis. This includes studying the economic indicators and political events that could impact the currency's value, as well as using technical analysis tools to identify potential entry and exit points. It's also crucial to have a well-defined trading strategy and risk management plan. This should include setting stop-loss orders to limit potential losses and take-profit orders to secure profits. Always trade with a reputable broker, such as XM Broker, that is regulated by a reputable financial authority. A regulated broker provides a safe and transparent trading environment. Stay disciplined and stick to your trading plan. Avoid making impulsive decisions based on emotions or speculation.

Factors Influencing Currency Pair Values

Several factors influence the values of currency pairs. Economic indicators, such as GDP growth, inflation rates, and employment figures, can provide insights into a country's economic health. Strong economic data generally leads to an appreciation of the currency, while weak data can cause it to depreciate. Political events, such as elections, policy changes, and geopolitical tensions, can also have a significant impact on currency values. Political instability can create uncertainty and lead to capital flight, causing the currency to fall. Central bank policies, such as interest rate decisions and quantitative easing programs, can influence currency values by affecting the money supply and borrowing costs.

Supply and demand for a currency also plays a crucial role in determining its value. Demand for a currency can increase if a country's exports are in high demand or if foreign investors are attracted to its assets. Conversely, supply can increase if a country's imports are high or if domestic investors are selling the currency. Market sentiment and speculation can also influence currency values. If investors believe that a currency is undervalued or overvalued, they may take positions that drive its price in the direction they expect. For example, if a large hedge fund bets against a currency, it can create a self-fulfilling prophecy, leading to a significant price decline. Monitor these key factors to make informed trading decisions.

Tips for Trading Currency Pairs

Trading currency pairs requires a combination of knowledge, skills, and discipline. One of the most important tips is to develop a solid trading strategy that aligns with your risk tolerance and goals. This strategy should include clear entry and exit rules, as well as a risk management plan. Before entering a trade, always conduct thorough research and analysis. This includes studying economic indicators, political events, and technical charts. Use a combination of fundamental and technical analysis to identify potential trading opportunities. It is also crucial to manage your risk effectively. Use stop-loss orders to limit your potential losses and take-profit orders to secure your profits. Avoid risking more than a small percentage of your capital on any single trade.

Stay disciplined and stick to your trading plan. Avoid making impulsive decisions based on emotions or speculation. Keep a trading journal to track your trades, analyze your performance, and identify areas for improvement. It is important to stay informed about market news and developments. Follow reputable financial news sources and economic calendars to stay up-to-date on the latest events. Be patient and persistent. Forex trading is not a get-rich-quick scheme. It requires time, effort, and dedication to master. Learn from your mistakes and continuously improve your trading skills. Finally, remember that forex trading involves risks, and it's possible to lose money. Never trade with money you cannot afford to lose. Start with a demo account to practice your skills before trading with real money.

Common Mistakes to Avoid When Trading Currency Pairs

Many beginners make common mistakes that can lead to losses. One of the biggest mistakes is trading without a well-defined strategy. Without a strategy, you're essentially gambling. Another mistake is risking too much capital on a single trade. This can quickly deplete your account if the trade goes against you. Overleveraging is another common mistake. Leverage can magnify your profits, but it can also magnify your losses. Use leverage cautiously and only when you understand the risks. Ignoring risk management is another critical mistake. Always use stop-loss orders to limit your potential losses. Emotional trading can also lead to mistakes. Avoid making impulsive decisions based on fear, greed, or excitement.

Failing to stay informed about market news and developments can also be detrimental. Stay up-to-date on economic indicators, political events, and other factors that can influence currency values. Copying the trades of others without understanding the rationale behind them is another mistake. Learn to analyze the market and make your own trading decisions. Finally, failing to track your trades and analyze your performance is a missed opportunity for improvement. Keep a trading journal to identify your strengths and weaknesses. Learn from your mistakes and continuously improve your trading skills. Avoid these common mistakes to improve your chances of success in the Forex market.

Fun Facts About Currency Pairs

Did you know that the Forex market is the largest and most liquid financial market in the world, with trillions of dollars changing hands every day? The EUR/USD is the most traded currency pair, accounting for a significant portion of the total trading volume. The term "cable" is often used to refer to the GBP/USD pair, a historical reference to the transatlantic cable used to transmit exchange rates between London and New York in the 19th century. Currency pairs are traded 24 hours a day, five days a week, allowing traders to participate from anywhere in the world.

The value of a currency pair can be influenced by factors ranging from interest rate decisions to political events. Major economic news announcements, such as GDP releases and employment reports, can trigger significant price movements in currency pairs. Central banks play a crucial role in managing their country's currency by setting interest rates and intervening in the foreign exchange market. Some traders use technical analysis tools, such as Fibonacci retracements and Elliott Wave theory, to identify potential trading opportunities in currency pairs. Forex trading can be both challenging and rewarding, offering opportunities for profit but also involving risks that must be carefully managed.

How to Trade Currency Pairs

Trading currency pairs involves buying one currency and selling another simultaneously. The goal is to profit from changes in the exchange rate between the two currencies. To start trading currency pairs, you need to open an account with a reputable Forex broker. The broker will provide you with a trading platform that allows you to access the Forex market and execute trades. Before trading with real money, it's a good idea to practice with a demo account. This allows you to familiarize yourself with the trading platform and test your strategies without risking any capital. Once you're comfortable, you can deposit funds into your trading account and start trading.

To place a trade, you need to select the currency pair you want to trade, specify the trade size, and choose whether to buy or sell. If you believe the base currency will increase in value relative to the quote currency, you would "buy" the pair. Conversely, if you believe the base currency will decrease in value, you would "sell" the pair. You can also set stop-loss orders to limit your potential losses and take-profit orders to secure your profits. After you've placed your trade, it will be executed by the broker and you will see the results in your trading account. Monitor your trades and adjust your strategy as needed. It is important to manage your risk effectively and stay disciplined.

What if I Don't Understand Currency Pairs?

If you don't understand currency pairs, don't worry! It's a common feeling for beginners. The good news is that it's entirely possible to learn. Start by focusing on the basics: what a currency pair is, the difference between the base and quote currency, and the factors that influence their values. There are countless resources available online, including articles, tutorials, and videos. Take advantage of these resources to build your knowledge. Consider taking a Forex trading course or workshop. These courses can provide structured learning and hands-on experience. Practice with a demo account. This allows you to experiment with different trading strategies and get comfortable with the trading platform without risking any real money.

Don't be afraid to ask for help. There are many online forums and communities where you can ask questions and learn from experienced traders. Start with a simple strategy and gradually increase your complexity as you gain knowledge and experience. Focus on managing your risk and protecting your capital. Trade with a regulated broker that offers educational resources and support. Remember that learning Forex trading takes time and effort. Be patient and persistent, and don't get discouraged by initial losses. With dedication and the right resources, you can learn to understand and trade currency pairs successfully.

Listicle of Top Tips for Trading Currency Pairs

1.Develop a Solid Trading Strategy: A well-defined strategy is essential for success. It should include clear entry and exit rules, as well as a risk management plan.

2.Conduct Thorough Research and Analysis: Before entering a trade, study economic indicators, political events, and technical charts.

3.Manage Your Risk Effectively: Use stop-loss orders to limit potential losses and take-profit orders to secure profits. Avoid risking more than a small percentage of your capital on any single trade.

4.Stay Disciplined and Stick to Your Plan: Avoid making impulsive decisions based on emotions or speculation.

5.Keep a Trading Journal: Track your trades, analyze your performance, and identify areas for improvement.

6.Stay Informed About Market News: Follow reputable financial news sources and economic calendars to stay up-to-date on the latest events.

7.Be Patient and Persistent: Forex trading is not a get-rich-quick scheme. It requires time, effort, and dedication to master.

8.Learn from Your Mistakes: Continuously improve your trading skills by analyzing your past trades.

9.Start with a Demo Account: Practice your skills and strategies before trading with real money.

10.Trade with a Reputable Broker: Choose a regulated broker that offers a safe and transparent trading environment.

Question and Answer

Q: What is a currency pair?

A: A currency pair is a quotation of two different currencies, with the value of one currency being relative to the other. It consists of a base currency and a quote currency.

Q: What is the difference between the base and quote currency?

A: The base currency is the first currency listed in a currency pair, while the quote currency is the second. The price of the currency pair indicates how much of the quote currency is needed to buy one unit of the base currency.

Q: What are the major currency pairs?

A: The major currency pairs are the most frequently traded pairs and involve the US dollar (USD) paired with another major currency, such as EUR/USD, USD/JPY, GBP/USD, USD/CHF, AUD/USD, USD/CAD, and NZD/USD.

Q: What are some of the factors that influence currency pair values?

A: Several factors influence currency pair values, including economic indicators, political events, central bank policies, supply and demand, and market sentiment.

Conclusion of What Are Currency Pairs in Forex?

Understanding currency pairs is the cornerstone of Forex trading. From grasping the basics of base and quote currencies to navigating the complexities of major, minor, and exotic pairs, this knowledge empowers you to make informed trading decisions. Remember to stay disciplined, manage your risk, and continuously learn and adapt to the ever-changing market dynamics. And, for those seeking a reliable platform to embark on their Forex journey, consider exploring XM Broker. With the right tools and knowledge, you can unlock the potential of the Forex market and achieve your financial goals.

0 Reviews

Your rating