Ever felt like the global markets are whispering secrets you can't quite decipher? The Forex market, a 24-hour beast, can feel particularly elusive. Understanding its rhythm, its peaks and valleys, is crucial for any aspiring trader. Are you trading at the right time?

Many new Forex traders jump in without truly grasping the nuances of trading times. This can lead to missed opportunities, increased volatility exposure, and ultimately, frustration. Imagine waking up early, ready to trade, only to find the market unusually quiet, or entering a trade at a time when liquidity is thin and spreads are wide. These are the kinds of challenges that a solid understanding of Forex trading hours and sessions can help you avoid.

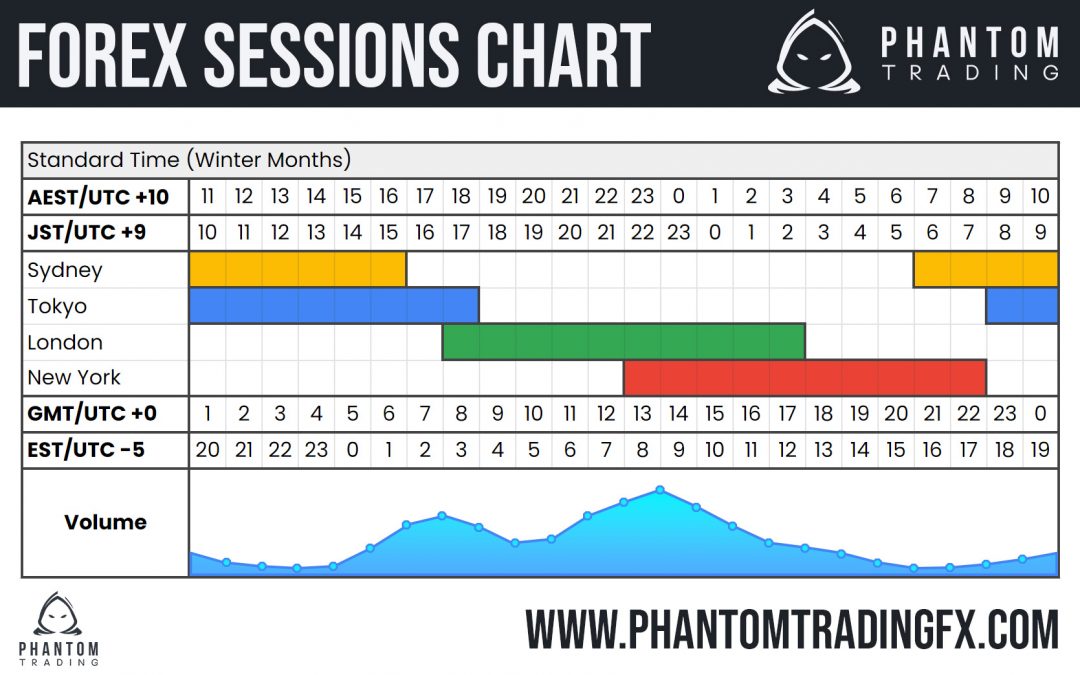

So, what are Forex trading hours and sessions? Simply put, the Forex market operates 24 hours a day, five days a week, because it's a global, decentralized market. However, this doesn't mean it's active around the clock. Instead, the Forex market operates in distinct trading sessions, each characterized by different levels of activity and volatility. These sessions are primarily based on the business hours of major financial centers around the world: Sydney, Tokyo, London, and New York.

In this post, we'll explore the importance of understanding Forex trading hours and sessions, how they impact your trading strategy, and how to tailor your approach for optimal results. We'll delve into the specific characteristics of each major session, uncover some hidden secrets, and equip you with the knowledge you need to navigate the Forex market with confidence. Knowing the Forex trading sessions is vital, as are the Forex market hours, Forex sessions overlap, major currency pairs, market volatility, trading strategy, and best time to trade.

Understanding the Major Forex Trading Sessions

I remember my early days in Forex trading, completely oblivious to the impact of different trading sessions. I'd trade whenever I had a free moment, regardless of the time of day, and often wondered why my results were so inconsistent. There were some days, I'd lose more money than I'd earn. It wasn't until I started studying the market hours and the nuances of each session that I began to see a significant improvement in my trading performance. I began to understand Forex sessions overlap, which helped my understanding even more.

The Forex market is essentially a network of interconnected financial centers, each operating during its respective business hours. This creates four major trading sessions: the Sydney session, the Tokyo session, the London session, and the New York session. Each session has its own unique characteristics, including trading volume, volatility, and currency pair preferences. For instance, the Sydney and Tokyo sessions tend to be more active with Asian currencies like the AUD and JPY, while the London and New York sessions see higher trading volume in major currency pairs like EUR/USD and GBP/USD. Understanding these differences is crucial for developing a targeted trading strategy.

During the London session, for example, you often see a surge in volatility and trading volume as European businesses and institutions begin their trading day. This can present opportunities for traders who are looking to capitalize on short-term price movements. However, it also comes with increased risk, as sudden news releases or economic data can trigger rapid market fluctuations. It's important to be aware of these potential pitfalls and to manage your risk accordingly. By learning about the Forex market hours, you can better plan your trading days and make informed decisions based on the prevailing market conditions.

What are Forex Trading Sessions?

Forex trading sessions refer to the specific periods of time when major financial centers around the world are open for business and actively trading currencies. Because the Forex market is decentralized and operates globally, trading occurs 24 hours a day, five days a week. However, the level of activity and volatility varies significantly depending on which trading session is in progress. These sessions are loosely based on the business hours of major cities, including Sydney, Tokyo, London, and New York.

Each of these Forex sessions has its own distinct characteristics. For example, the Sydney session, being the first to open each trading day, is generally quieter and less volatile compared to the London or New York sessions. The Tokyo session, also known as the Asian session, tends to see higher trading volumes in Asian currency pairs. The London session, which often overlaps with the end of the Asian session and the beginning of the New York session, is typically the most active and volatile of the four. The New York session, influenced by economic data releases and news events in the United States, can also experience significant price swings. Understanding these differences is essential for adapting your trading strategy and managing risk effectively.

Moreover, it's important to consider the Forex sessions overlap. These are periods of increased liquidity and volatility, as two major financial centers are operating simultaneously. For instance, the overlap between the London and New York sessions is often considered the most liquid and volatile time to trade, as traders from both regions are actively participating in the market. This can create opportunities for both short-term and long-term traders, but it also requires careful risk management to avoid being caught on the wrong side of a sudden price movement. Knowing about major currency pairs, market volatility, trading strategy, and the best time to trade is also key to success.

The History and Myth of Forex Trading Hours

The history of Forex trading hours is intertwined with the evolution of global finance and communication. Before the advent of electronic trading, Forex transactions were primarily conducted during the traditional business hours of major financial centers. However, as technology advanced and the world became more interconnected, the Forex market gradually evolved into a 24-hour global marketplace.

One common myth is that Forex trading is a guaranteed path to riches. While it's true that some traders have achieved significant success in the Forex market, it's also important to recognize that it's a high-risk, high-reward endeavor. It requires discipline, knowledge, and a solid trading strategy to consistently generate profits. There is a great deal of understanding needed when learning about the Forex sessions overlap, Forex market hours, major currency pairs, market volatility, trading strategy, and best time to trade.

Another myth is that you need a large amount of capital to start trading Forex. While having sufficient capital is certainly an advantage, many brokers offer micro accounts that allow you to trade with as little as $100. This makes Forex trading accessible to a wider range of individuals, but it's still important to manage your risk carefully and avoid over-leveraging your account. Furthermore, there's a myth that certain times are best for trading. While volatility can be associated with certain sessions, it's always possible to find good opportunities in any given session. What's more important is to consider the factors that influence price, and to make sure that your trading system has an edge.

Hidden Secrets of Forex Trading Hours

One of the hidden secrets of Forex trading hours is the "dead zone." This refers to the period between the end of the New York session and the beginning of the Sydney session, when liquidity is typically thin and trading activity is subdued. Many experienced traders avoid trading during this time, as the lack of liquidity can lead to wider spreads and unpredictable price movements. It is something to keep in mind when trading during Forex sessions overlap, because the Forex market hours can change.

Another secret is the importance of understanding economic calendars and news releases. Major economic data releases, such as GDP figures, inflation reports, and employment numbers, can have a significant impact on currency prices. Traders who are aware of these events and understand how to interpret the data can often profit from the resulting market volatility. Furthermore, it's important to be aware of unexpected news events, such as political announcements or natural disasters, which can also trigger sudden price swings. Learning about major currency pairs, market volatility, trading strategy, and the best time to trade will help you navigate the market.

A third secret is the value of using a Forex VPS (Virtual Private Server). A VPS allows you to run your trading platform 24/7, even when your computer is turned off. This can be particularly beneficial if you're using automated trading strategies or expert advisors, as it ensures that your trades are executed without interruption. A reliable VPS can also provide faster execution speeds and lower latency, which can be crucial in a fast-moving market. Many brokers are able to provide access to a VPS. There are some brokers that offer it for free as long as the customer meets certain requirements. The most common requirement is for the trader to have at least a minimum of funds in the account. The minimum requirement varies from one broker to another.

Recommendations for Trading During Forex Trading Sessions

If you're new to Forex trading, a good starting point is to focus on trading during the London and New York sessions. These are typically the most liquid and volatile times of the day, which can provide more opportunities for profitable trades. However, it's also important to manage your risk carefully and avoid over-leveraging your account. Remember that with increased volatility comes increased risk. To begin with, it's beneficial to develop a basic strategy and stick to it. As you become more experienced, you can branch out into other strategies.

It's also important to choose a reputable Forex broker that offers competitive spreads, reliable execution, and a user-friendly trading platform. Look for brokers that are regulated by reputable financial authorities and have a proven track record of customer service. Consider checking out XM Broker. Many brokers offer demo accounts that allow you to practice trading with virtual money before risking your own capital. This can be a great way to familiarize yourself with the trading platform and test different strategies without any financial risk.

Finally, remember that Forex trading is a marathon, not a sprint. It takes time, patience, and dedication to develop the skills and knowledge necessary to become a successful trader. Don't get discouraged by early losses, and always be willing to learn from your mistakes. Continuously educate yourself about the market, stay up-to-date on economic news and events, and adapt your strategy as needed. By following these recommendations, you can increase your chances of success in the Forex market. Always remember to be realistic and patient.

Choosing the Right Currency Pairs for Each Session

Different currency pairs tend to be more active during certain trading sessions. For example, Asian currency pairs like USD/JPY and AUD/USD often see higher trading volumes during the Tokyo and Sydney sessions, while European currency pairs like EUR/USD and GBP/USD are typically more active during the London and New York sessions. Understanding these patterns can help you focus on the currency pairs that are most likely to offer profitable trading opportunities during the session you're trading.

If you're trading during the Asian session, consider focusing on currency pairs that involve the Japanese Yen (JPY), Australian Dollar (AUD), or New Zealand Dollar (NZD). These currencies are often more volatile during this session due to the influence of Asian economic news and events. Similarly, if you're trading during the European session, you might want to focus on currency pairs that involve the Euro (EUR), British Pound (GBP), or Swiss Franc (CHF). These currencies are typically more active during this session due to the influence of European economic data and news releases.

It's also important to consider the Forex sessions overlap, as these are often the most liquid and volatile times of the day. For instance, the overlap between the London and New York sessions can be a great time to trade major currency pairs like EUR/USD and GBP/USD, as there is a high level of trading activity from both European and North American traders. By carefully selecting the right currency pairs for each session, you can increase your chances of finding profitable trading opportunities and maximizing your trading efficiency. Keep in mind the Forex market hours, market volatility, and the best time to trade.

Tips for Trading During Different Forex Trading Sessions

One of the most important tips for trading during different Forex trading sessions is to adapt your strategy to the prevailing market conditions. For example, if you're trading during the Asian session, when liquidity is typically lower, you might want to focus on range-bound trading strategies or scalping techniques. These strategies can be effective in capitalizing on small price movements within a defined range.

During the more volatile London and New York sessions, you might want to consider using breakout strategies or trend-following techniques. These strategies can be effective in capturing larger price movements that occur when the market is more active and directional. It's also important to be aware of economic news releases and events that could impact currency prices. Economic calendars can help you track upcoming events and prepare for potential market volatility. Trading strategy should be adjusted as needed.

Another useful tip is to use stop-loss orders to protect your capital. A stop-loss order is an instruction to your broker to automatically close your position if the price reaches a certain level. This can help you limit your losses and prevent your account from being wiped out by unexpected price movements. It's also important to avoid over-leveraging your account, as this can magnify both your profits and your losses. A general rule of thumb is to risk no more than 1-2% of your capital on any single trade. By following these tips, you can improve your trading performance and manage your risk more effectively. Also make sure you know the best time to trade.

Understanding the Intermarket Relationships

Understanding intermarket relationships can provide valuable insights into potential trading opportunities. For example, the Forex market is often influenced by the stock market, bond market, and commodity market. Changes in these markets can sometimes foreshadow movements in currency prices.

For instance, if the stock market is rising, it could indicate a positive outlook for the economy, which could lead to an appreciation in the local currency. Conversely, if the stock market is falling, it could signal economic weakness, which could lead to a depreciation in the local currency. Similarly, changes in bond yields can also influence currency prices. Higher bond yields can attract foreign investment, which can increase demand for the local currency.

Commodity prices, particularly those of oil and gold, can also have an impact on certain currencies. For example, the Canadian Dollar (CAD) is often correlated with the price of oil, as Canada is a major oil exporter. Similarly, the Australian Dollar (AUD) is often correlated with the price of gold, as Australia is a major gold producer. By understanding these intermarket relationships, you can gain a more comprehensive view of the market and make more informed trading decisions. Forex sessions overlap can also influence the market. Make sure you also keep an eye on major currency pairs, and market volatility.

Fun Facts About Forex Trading Hours

Did you know that the Forex market never truly sleeps? While major financial centers operate during specific hours, trading activity continues around the clock, driven by different regions and time zones. This 24-hour nature of the market is one of the things that makes it so unique and appealing to traders around the world. The Forex market hours allow all traders to participate around the world.

Another fun fact is that the Forex market is the largest and most liquid financial market in the world. Daily trading volume is estimated to be in the trillions of dollars, dwarfing the trading volume of other markets like stocks and bonds. This high level of liquidity makes it easier to enter and exit trades quickly and efficiently, which is important for both short-term and long-term traders. This is why the best time to trade might be important to you.

Furthermore, the Forex market is incredibly diverse, with hundreds of different currency pairs available for trading. This provides traders with a wide range of opportunities to diversify their portfolios and capitalize on different market conditions. However, it also means that it's important to do your research and understand the characteristics of each currency pair before trading it. Also, remember that the Forex sessions overlap. Also, be sure to understand major currency pairs and market volatility.

How to Develop a Trading Plan Based on Forex Trading Hours

Developing a trading plan based on Forex trading hours involves several key steps. First, you need to identify the trading sessions that align with your personal schedule and trading style. If you're a morning person, you might prefer to trade during the Asian session, while if you're a night owl, you might prefer to trade during the New York session. It is important to know when is the best time to trade.

Next, you need to research the characteristics of each session and identify the currency pairs that are most active during those hours. You can use historical data and market analysis to identify these patterns. Once you've identified your preferred trading sessions and currency pairs, you can start developing a specific trading strategy for each session. This should include entry and exit rules, risk management guidelines, and position sizing techniques. Forex sessions overlap can also play a roll in your trading plan.

It's also important to backtest your trading strategy to see how it would have performed in the past. This can help you identify potential weaknesses in your strategy and make adjustments as needed. Finally, remember that your trading plan is not set in stone. You should be prepared to adapt it as market conditions change and as you gain more experience as a trader. By following these steps, you can develop a comprehensive trading plan that takes into account the nuances of Forex trading hours. Knowing the Forex market hours is a great advantage to have.

What if You Could Master Forex Trading Hours?

Imagine the possibilities if you could truly master Forex trading hours. You'd be able to identify the most profitable trading opportunities with greater accuracy, manage your risk more effectively, and potentially generate consistent profits over time. This mastery would involve not just understanding the different trading sessions, but also recognizing the underlying factors that drive price movements during those sessions. Knowing the best time to trade can help you in achieving this.

You'd be able to anticipate economic news releases and events that could impact currency prices, and you'd be able to adjust your strategy accordingly. You'd also be able to recognize the signs of a potential trend reversal or breakout, and you'd be able to position yourself to profit from those movements. This level of expertise would require a deep understanding of technical analysis, fundamental analysis, and market psychology. Knowledge of market volatility is crucial.

Moreover, mastering Forex trading hours would allow you to trade with greater confidence and discipline. You'd be less likely to be swayed by emotions like fear and greed, and you'd be more likely to stick to your trading plan, even during periods of market turbulence. This would require a high level of self-awareness and emotional control. While it's unlikely that anyone can truly "master" the Forex market, striving for this level of expertise can lead to significant improvements in your trading performance. Remember to take advantage of Forex sessions overlap, which can also increase your chances of profiting from the market.

Listicle of Key Takeaways About Forex Trading Hours

Here's a quick listicle summarizing the key takeaways about Forex trading hours:

- The Forex market operates 24 hours a day, five days a week.

- Trading activity is concentrated in four major sessions: Sydney, Tokyo, London, and New York.

- Each session has its own unique characteristics in terms of volatility and currency pair preferences.

- Forex sessions overlap can create periods of increased liquidity and volatility.

- Understanding economic news releases and events is crucial for trading during different sessions.

- Adapting your strategy to the prevailing market conditions is essential for success.

- Using stop-loss orders can help protect your capital.

- Choosing a reputable broker is important for reliable execution and customer service.

- Continuously educating yourself about the market is key to long-term success.

- Mastering Forex trading hours can lead to improved trading performance.

Remember that Forex market hours might be different than what you are used to. Therefore, it is important to plan your days accordingly. You will also need to learn about major currency pairs, and the best time to trade.

Question and Answer

Here are some frequently asked questions about Forex trading hours:

Q: What are the best times to trade Forex?

A: The best times to trade Forex depend on your trading style and the currency pairs you're trading. However, the London and New York sessions are generally considered the most active and volatile times of the day. Also, the Forex sessions overlap will increase volatility.

Q: How do I choose the right currency pairs to trade during different sessions?

A: Research the characteristics of each session and identify the currency pairs that are most active during those hours. Asian currency pairs are often more active during the Tokyo and Sydney sessions, while European currency pairs are more active during the London and New York sessions. When choosing pairs, make sure that you are familiar with the Forex market hours.

Q: What are some common mistakes to avoid when trading during different sessions?

A: Common mistakes include trading during low-liquidity periods, ignoring economic news releases, over-leveraging your account, and failing to use stop-loss orders.

Q: How can I improve my trading performance by understanding Forex trading hours?

A: By understanding the characteristics of each session, adapting your strategy to the prevailing market conditions, and managing your risk effectively, you can improve your trading performance and potentially generate consistent profits. Furthermore, study market volatility and the best time to trade.

Conclusion of What Are Forex Trading Hours and Sessions?

Understanding Forex trading hours and sessions is paramount for any trader looking to navigate the global currency markets successfully. By grasping the nuances of each session, recognizing the impact of economic events, and tailoring your trading strategy accordingly, you can significantly enhance your chances of profitability. Remember that continuous learning and adaptation are key to thriving in the ever-evolving world of Forex trading. For further insights and resources, consider exploring brokers like XM.

0 Reviews

Your rating